This post was written in collaboration with Great Eastern. While we are financially compensated by them, we nonetheless strive to maintain our editorial integrity and review products with the same objective lens. We are committed to providing the best recommendations and advice in order for you to make personal financial decisions with confidence. You can view our Editorial Guidelines here.

When our parents were our age, things were much cheaper and they could survive on less. Today, we see many seniors continue to work past the retirement age, and the cost of living continues to increase with inflation.

For example, a bowl of noodles that may have cost just $2 a decade ago is now priced at $3.50. In the 1990s, $120,000 could get you a 5-room HDB BTO flat in mature estates such as Toa Payoh, but now that same amount can barely buy a 3-room BTO unit in a non-mature estate.

What will retirement look like when it’s our turn? Would we be able to afford our daily essentials and enjoy our silver years comfortably?

In a recent survey from insurer Great Eastern on the state of retirement in Singapore, those who didn’t plan for retirement are more likely to be dissatisfied with their retirement lifestyle (35%). This is 7 times more as compared to those retirees who planned with professional help and twice those who planned without professional help.

Retirees’ number one regret? Not starting sooner (45%), said those who had actually planned for retirement.

This underscores the need to not only plan for our retirement, but to do so early, to ensure that we can achieve a comfortable retirement lifestyle in the future.

Just how soon is soon enough? Or is it better late than never? How do we begin, and what does our current retirement progress bar look like? Let’s look at 3 common financial scenarios experienced by Singaporeans and how planning early and getting professional advice can help.

What does your ‘retire-meter’, AKA your retirement progress bar look like?

Have you ever used a retirement calculator to suss out how much you need to achieve your desired retirement lifestyle and when you’re financially able to retire? With your current financial situation, what retirement lifestyle can you realistically work towards?

To get you started, here are 3 financial scenarios commonly experienced by us (you probably can relate to some of them) and how their retirement progress bar looks like, according to Ms Riley Koh, a Great Eastern Financial Representative.

Scenario 1 – STARTING OUT & SAVING FOR THE FUTUREYou’re in your 20s, just graduated from school and started working. You’re likely still reliant on your parents for many things, including household expenses and accommodation, but you hope to become independent soon. Some of you may be paying off your education loans, while others may be saving up to marry your sweetheart and for your BTO. Riley says that people in this age group commonly feel that “retirement is still a long way to go and I can’t see that far ahead yet.” It’s understandable — with so many things to cater for, such as paying off their education loan, trying to save, or even planning for major milestones, planning for retirement may not yet be a priority. However, it’s important not to overlook long-term goals while working on short- to mid-term plans. Young adults are encouraged to cultivate good saving habits, build their protection coverage and start accumulating their wealth as early as possible. With compounding interest — assuming interest is the same — you can have a larger sum of savings despite saving less compared to someone who started at a later age with a bigger savings amount. If you delay, there will be less time for your money to grow and the harder you have to work to reach your retirement goals. |

Scenario 2 – ENTERING A NEW LIFE STAGE, GAINING NEW COMMITMENTSYou’re in your 30s, earning anywhere from $3,500 to $5,000 a month. You may have some additional revenue streams from dividend investing and/or a side hustle, and have amassed about $50,000 in savings. However, you may have a mortgage to pay, possibly children and/or parents (if they’ve retired) to support as well. Riley says that as one goes through the different milestones in life, it’s common to experience “lifestyle inflation” (spending more as your income goes up). If there’s no proper money management, one may end up overspending and derailing from their financial goals. By practicing good money habits, you can better achieve your desired goals. Inflation is a silent killer that erodes our spending power. If your savings amount is not keeping pace with inflation rate, you’re not earning any interest returns. That’s why investing is one of the key tools for our retirement planning. Some may shun investments because of certain misconceptions such as:

However, there are many types of investment and wealth accumulation plans with different risk levels and starting capital to help you reach your financial goals and build your retirement kitty. One example is GREAT Wealth Advantage, a regular premium whole life investment-linked plan which enables you to invest from as low as $200/month and with the option to invest in funds which are well-diversified and managed by professionals. You will enjoy welcome and loyalty bonuses which can help to accelerate the growth of your money. It also provides coverage against Death, Total and Permanent Disability and Terminal Illness with no medical underwriting required. |

Scenario 3 – SANDWICHED BUT STILL GOING STRONGYou’re in your 40s. Like it or not, you’re starting to feel kanchiong (anxious) about retirement and you’ve started, but you’re not sure if it’s enough to set aside $200 a month. You’re worried if your CPF funds are sufficient for retirement as you have wiped out the entire amount to pay for your house in your late 20s/early 30s. You’ve also been using most of your savings for your kids’ education, university fees, mortgage and also supporting your aged parents. Riley weighs in: “As the cost of living continues to rise in Singapore and with a growing ageing population, we need to plan early so as to not carry on the trend of the ‘sandwich generation’.” At this stage, it is important to diversify and not to put all your eggs into one basket to avoid the scenarios below:

If you are looking to build a versatile retirement nest egg with guaranteed regular payouts, you can consider participating insurance plans such as GREAT Lifetime Payout and GREAT Retire Income as part of your retirement planning. These solutions provide some capital preservation, flexibility and a stable stream of income to cater for your needs such as children’s education, your own retirement etc. GREAT Lifetime Payout has a unique proposition which provides you with a lifetime monthly payout with capital preservation. So that you can use it when you need extra financial resources or choose to leave a legacy for your loved ones. It is never too early/late to plan for retirement. It is more important to be clear about your financial goals and maximise your resources in getting there. |

These financial scenarios are by no means extensive, and are only meant to highlight common situations. For a personalised and holistic retirement plan, it’s best to consult a professional financial representative who can help you review your retirement planning needs.

Similar to how we have regular medical check-ups to ensure we stay in the pink of health, getting professional advice from an experienced financial representative will help you to build and maintain good financial health.

How to start planning for your retirement

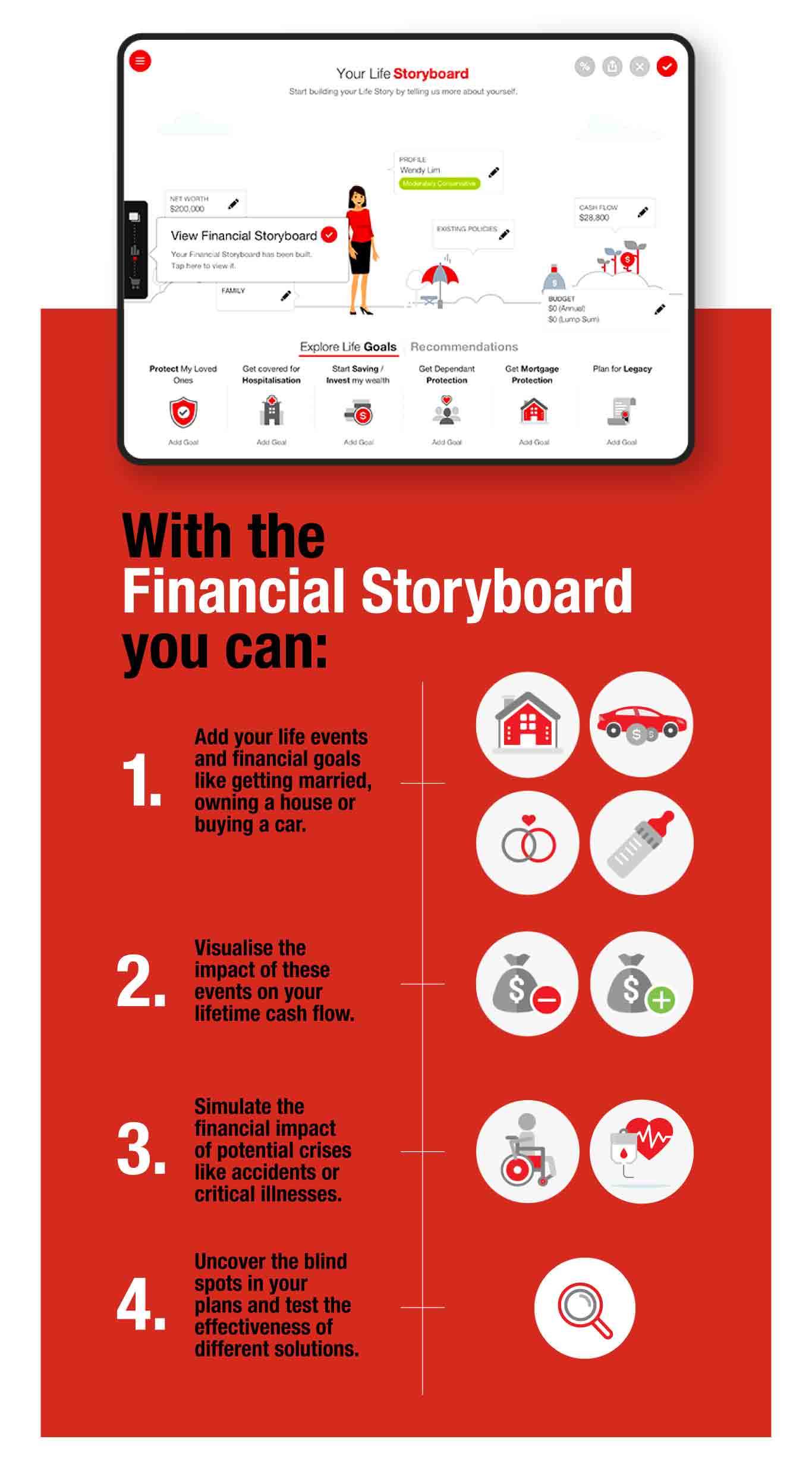

The first order of business when planning for retirement is to draw up your financial storyboard. This helps you see past any blind spots such as optimism bias (i.e. that voice in your head telling you that the worst won’t happen and that your current protection is adequate, even though that may not be the case) and stress-tests your financial plans by simulating different life events.

Great Eastern’s Financial Storyboard makes it simple to plan for your financial goals early with the help of professional advice — and not only for retirement.

Going back to Great Eastern’s state of retirement in Singapore survey, the difference between those who planned for their retirement with and without professional help is quite significant.

The survey findings showed that those who planned their retirement with professional help had $605 more on average to spend as they wish. This is almost twice the amount than those who planned for retirement without professional advice (an average of $330 extra to spend per month).

Those who planned for retirement before they reached age 50 (52%) are significantly better off with $625 extra to spend each month. Unfortunately, retirees who didn’t plan at all had only about $30 extra per month to spend — that’s about $1 a day (monthly income minus monthly expenses).

In fact, most retirees didn’t consider if they would have enough to spend for the next 10 to 20 years of their lives. For many in the survey, their top 3 income sources were their savings (56%), allowances from family (41%) and CPF LIFE (43%). And 11% of the retirees surveyed said they still needed to work as they still had ongoing commitments and debts such as housing and car loans.

Survey takeaways? Start early, and seek professional advice. The sooner you begin, the easier it is to amass the amount needed for your retirement.

To help you get started, consider Great Eastern’s retirement-focused participating insurance plans, GREAT Lifetime Payout and GREAT Retire Income. Here’s a quick look at their key features:

| GREAT Lifetime Payout | GREAT Retire Income |

|

|

Plan your Financial Storyboard with Great Eastern by 31 December 2021 and receive $20 worth of GREAT Dollars to redeem exclusive deals on the Great Eastern Rewards app! Click here for more details.

Footnotes:

1 Monthly payout comprises of guaranteed survival benefit and non-guaranteed cash bonus. 3.00% p.a. of total annual premiums paid is based on an Illustrated Investment Rate of Return (IIRR) of the Participating Fund at 4.25% p.a.. At an IIRR of 3.00% p.a., the monthly payout is 1.94% p.a. of the total annual premiums paid. The actual benefits payable may vary accordingly to the future experience of the Participating Fund.

2 Capital guarantee is on the condition that premiums are paid by annual mode and no policy alterations are made.

3 For a 35-year-old male with a 20-year premium term, selected retirement of age 71 and income period of 20 years on accumulation option, at an Illustrated Investment Rate of Return (IIRR) of the Participating Fund at 4.25% p.a.. At an IIRR of 3% p.a., the total retirement income benefits received is up to 2.7X of total premiums paid at policy maturity.

4 Capital guarantee is on the condition that no policy alterations are made.

5 Loss of Independence (LOI) income benefit is payable if the Life Assured, as certified by a medical practitioner, is unable without the continual physical assistance of another person to perform 2 or more Activities of Daily Living (ADLs). ADLs include washing, dressing, feeding, walking or moving around and transferring.

6 Protection against total and permanent disability is from the start of the policy till before the policy anniversary on which the Life Assured reaches the selected retirement age.

7 Based on a 20-year premium term, premium illustrated is rounded down to the nearest 10 dollar. Please refer to policy illustration for actual premium amount.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Terms and Conditions apply. Protected up to specified limits by SDIC.

As buying a life insurance policy is a long-term commitment, early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid.

Investments in GREAT Wealth Advantage are subject to investment risks including the possible loss of the principal amount invested. The value of the units in the Fund(s) and the income accruing to the units, if any, may fall or rise. Please refer to Fund Details and Product Highlights Sheet for the specific risks of the Fund(s). Past performance is not necessarily indicative of future performance.